1,803

Housing Starts

Planned completions for 2025

12%

Leading position in San Diego

Market Share

91

Active Projects

Setting the pace for infill development

Competing alongside institutional giants, SDRE’s local expertise and vertically integrated model position it for both volume and efficiency.

Our projects are delivered faster, more effectively leased, and built for long term ownership in mind.

In a market where most firms average less than 5% share, SDRE is setting the pace for multifamily housing in San Diego.

Current Footprint

Current Projects: 91

Current Owned & Controlled Units: > 2,000

AUM Book Value: $156,000,000

AUM Completed Value: $751,000,000

Average YOC: 7-10%

Average IRR: 100%+

Average Multiplier: 1.7 - 2.5%

Neighborhoods: Clairemont, Carlsbad, Bay Ho, La Mesa, Linda Vista, Encanto, Oceanside, Pacific Beach, and more

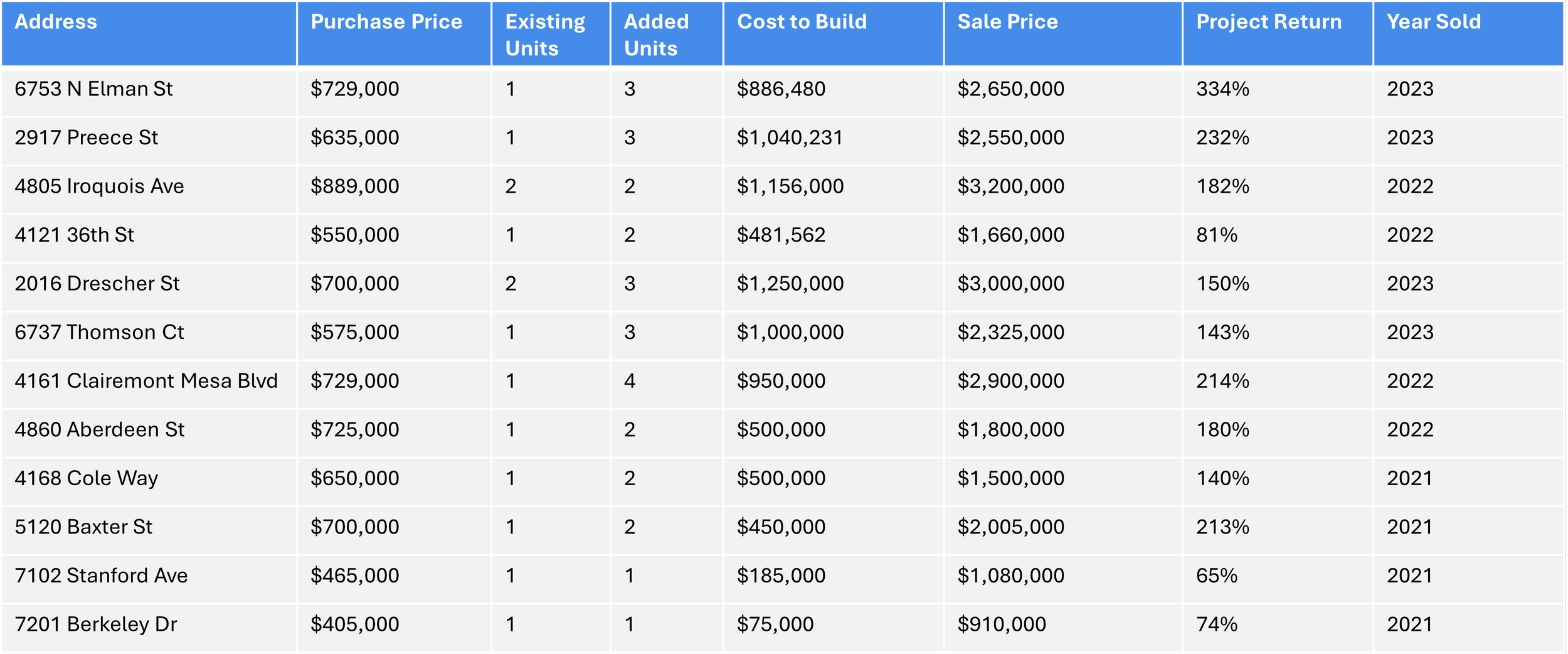

TRACK RECORD

Summary of Capital Raised

$468M

Total Capital Raised

SDRE to Date

$7.5B

Total Capital Raised

Partners Track Records to Date

Debt and Equity Partnerships and Relationships

⚫

Fortress

⚫

Artemis Real Estate Partners

⚫

Brookfield Asset Management

⚫

Resmark Equity Partners

⚫

IHP Capital Partners

⚫

Hearthstone

⚫

Comerica Bank

⚫

California Bank and Trust

⚫

Anchor

⚫

Kiavi

⚫

Renovo

⚫

Debt and Equity Partnerships and Relationships ⚫ Fortress ⚫ Artemis Real Estate Partners ⚫ Brookfield Asset Management ⚫ Resmark Equity Partners ⚫ IHP Capital Partners ⚫ Hearthstone ⚫ Comerica Bank ⚫ California Bank and Trust ⚫ Anchor ⚫ Kiavi ⚫ Renovo ⚫

Any statements made in this presentation are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or result expressed or implied by such forward-looking statements.

All investments, including real estate, is speculative in nature and involves a risk of loss. We encourage any investors to invest carefully. We also encourage investors to get personal advice from your professional investment advisor, CPA or other trusted financial advisor and to make independent investigations before acting. IT IS IMPORTANT YOU UNDERSTAND THAT WHILE WE ARE PROVIDING PROJECTIONS BASED ON THE FACTS AND FIGURES AVAILABLE, NO ONE CAN TRULY PREDICT THE FUTURE